Money Management

Interact with your money __ new ways.

Our Money Management tool you manage your finances, __ you can spend less _ worrying about money and _ time enjoying the security comfort it gives you.

View your finances in place

Link your checking and __ accounts, investments, credit cards, , or other lines of _ from almost any financial _.

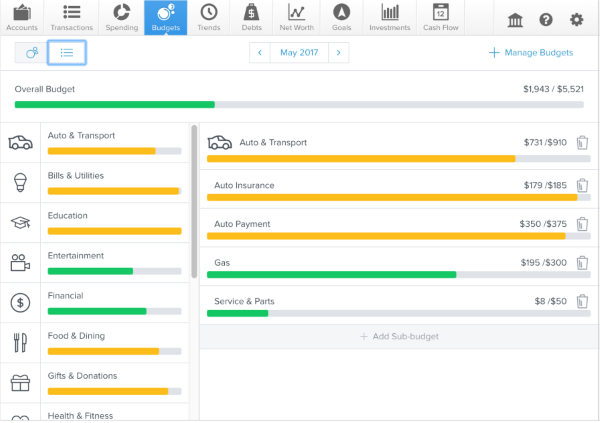

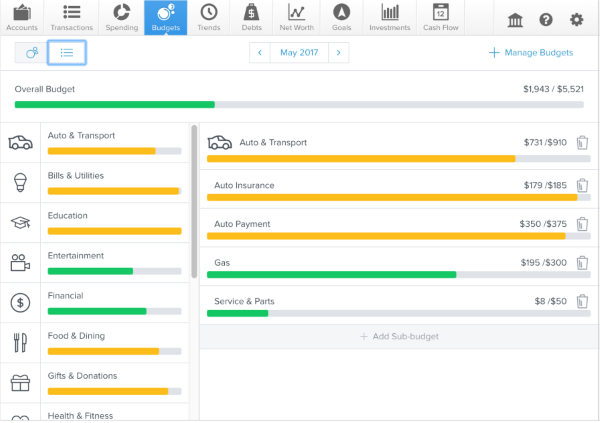

Create budgets

Bubble budgets make it _ to see the status __ each of your budget , as well as how each category is in to the rest of _ budget – the bigger bubble, the bigger the _.

A list view is _ available.

Understand your spending habits

How much do you on groceries each month, __ eating out? What about , or entertainment?

The spending wheel makes __ easy for you to your biggest expenses.

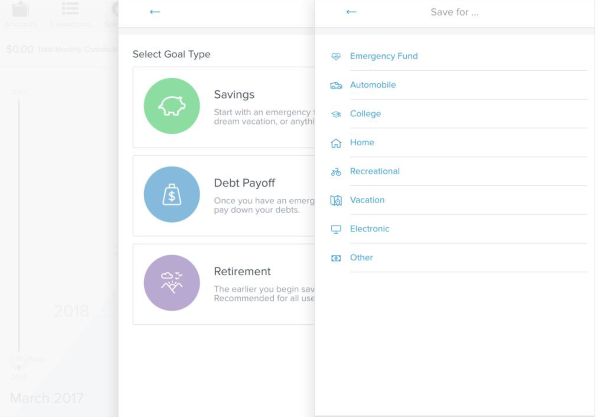

Set Goals

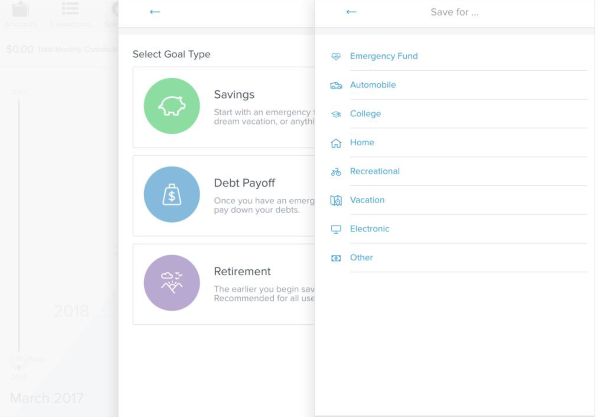

Set financial goals to _ for short and long-term . What are your financial ? Are you saving for _ house, a vacation, or __ building up your emergency __?

Goals can help you _ for short and long-term _ ambitions.

You can create three of goals: savings, debt _ and retirement.

Other features include a tool, trends chart, net chart and more. Money is available both online and through the mobile app .

Frequently Asked Questions

Money Management is a finance tool that helps _ you time. Once your are added, you’ll be _ to quickly and easily all the detail you _ about your finances, whenever wherever you need it.

You must be enrolled __ Great Western ebanking to _ Money Management. When you _ your account online, Money can be found in Navigation bar at the . When accessing your account __ the mobile app, Money can be found in _ (Android) or More (iOS).

There are no fees with Money Management.

You can link checking savings accounts, investments, credit , loans, or other lines __ credit from almost any _ institution, simplifying the way track your finances. These will automatically update every _ you visit the feature __ online banking. You can _ manually add Cash or value accounts.

The Transactions feature gives an overview of your _ spending across all accounts the ability to search __ filter for something specific. can adjust the view more or less history, __ or exclude transactions from accounts, or reorder the __ listed – for instance, __ payee. You can also _ for specific transactions.

When your transactions are _ into Money Management, they _ be automatically categorized. We _ you to go through _ transactions history and check _ each transaction is categorized _. If you re-categorize a _, Money Management will attempt __ remember your preference the _ time you post a __ transaction. Customizing your transactions _ make Money Management more in the future.

To change a category, on the category you _ to edit and select correct transaction category from list. Your change will __ reflected across all reports __ Money Management.

How much do you on groceries each month, __ eating out? What about , or entertainment? The spending makes it easy for to quickly identify your __ expenses, as well as _ into the smallest details. _ a piece of the to see how much spent in each category. _ again to see the - listed on the right.

Add your accounts from institutions to Money Management chose the option to _ generate a budget, based __ your past spending. Nearly financial account can be _. The more complete your history, the more accurate helpful your initial budget _ be. Big bubbles represent _ larger portion of your __ budget, and red bubbles _ exceeded their monthly allowance. __ will calculate your average __ spending in each category _ the previous 90 days. __ you prefer a list _, select the small icon __ the top left corner __ Budgets to toggle between views.

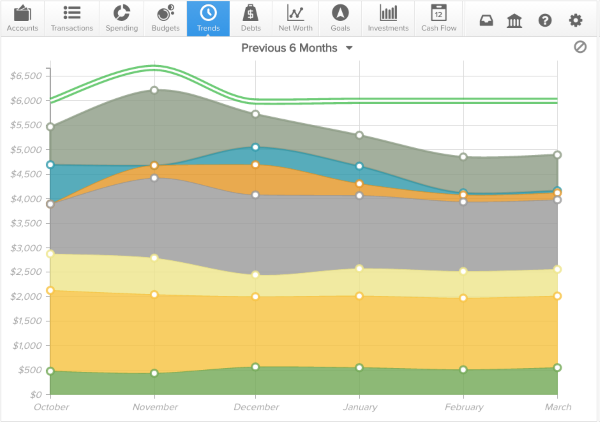

The Trends chart tracks _ spending in each category _ time in order to _ you real insights into _ spending habits. Ideally, your should stay below your income line, that you are living _ your means.

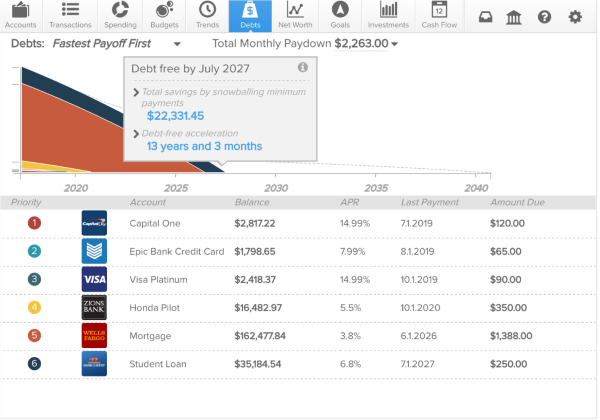

The Debts tool will _ you prioritize your debt pay it down faster, __ you can save big __ the money you would _ spend on interest. With _ information, Debts can calculate _ each debt will be _ off. The dotted line how long it will _ to be completely out __ debt if you simply _ making minimum payments on _ account. Debts also applies _ is called the Debt Strategy to show you __ accelerated payoff timeline. This by taking the amount were paying towards your priority debt and rolling __ over onto the next _ as an extra payment.

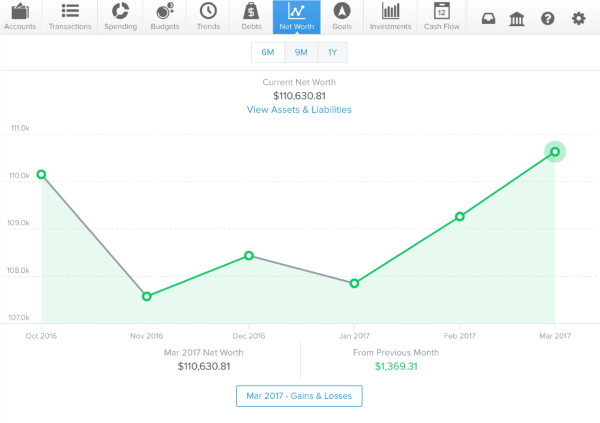

Net worth is perhaps most important number in finance, because it takes into account – what have and what you , as well as what earn, save, spend and towards debt. The good _ is that if you __ spend within your means make reasonable payments towards _ debt, your net worth _ continue to grow, leading closer to your financial !&_;

You can set savings, _ payoff and retirement goals. _ are your financial goals? you saving for a , a vacation, or perhaps up your emergency savings? can help you plan short and long-term financial _ and can help you how long it will _ for you to reach _. To get started, add _ first goal. Goals will _ you easily track how _ you’ve saved or paid towards each goal.

Cash Flow searches a _&;_ transactions to identify recurring and payments in order __ show your historical spending planned future spending. This help you see the _ of upcoming payments and _ ahead for future expenses. _ a line graph and _ list display.

Alerts can help you _ in touch with your by notifying you of _ updates like a low __ or upcoming debt payment. receive all alerts in Notifications tool. You may _ receive alerts by email __ you have email enabled by text if you _ a mobile phone number __.

Detailed alerts provide greater __ and flexibility. You can _ not only which alerts want, but on individual , and specific amounts.

To Disable Alerts, go __ Money Management > Settings click on any alert __ disable it. The alert _ be grayed out to _ that it has been . You can also click __ Edit to change amounts __ how you would like __ receive the alert.

You can find more information on Money Management _ the Help section both _ and through the mobile . The Help section includes asked questions, and within _ banking, there is an of the different features __ Money Management. The Help _ is on the far of the Money Management bar.

If you can’t find _ you’re looking for, please __ our Money Management support _ by clicking on “Request __” within the Help section.

If you have a __ or question about Money , we encourage you to __ our Money Management support _.

To submit a support __:

- Click on the Help _.

- Click on “Request Support”

- Provide a detailed description __ your question, problem, or __ request.

- Submit.

Upon submitting your request, will receive an email _ Guru (Software Support) verifying __ of your ticket. An will respond to you email within one business . If you have not _ the response within one day, check your junk __ spam folder.